as well as presenting a useful tool for shorter term capital accumulation through trading. The shorter the time frame with stocks.

A Stock Investment Strategy

So most individual investors are going to be seeking out long term increases.

-

01

Individual Investors

So time horizons differ greatly.

individual investors may plan on holding a stock from anywhere from a few minutes to a lifetime.

-

02

Time Horizon

Put another way, a longer time.

time horizon, the more relevant a company’s business results will be, and companies tend to appreciate in value.

-

03

Trading

The extreme version of trading.

we’re seeing a lot more of in the market these days, where trades often only last a few seconds.

planning on investing

If someone was only planning on investing for a couple of years.

* Interest rate up to 5% p.a

Long term stock holding

We still want to monitor the performance of a long term stock holding.

* Terms & Conditions

Longer time horizon

For this to even out though requires a longer time horizon.

* Check today’s Interest Rates

Real Estate Guide

There’s more to understanding real estate as an investment

than just looking to buy a home.

Real estate trading involves buying real estate with the intention of only holding it for the a short period of time, in order to look to sell it later for a profit.

There are two ways that you can invest in real estate, by actually buying property, called private investing, and by buying real estate securities.

The most obvious application of real estate valuation is property being bought and sold, where both sellers and buyers become very interested value of a property.

While there is no clear cut division between speculation and investment, and all investment essentially involves speculating on the value increasing on something.

Personal real estate refers to investing in real property that will be used for one’s own purposes, for instance a home, a second home, or a vacation property.

The real estate market, like all markets, is influenced by the forces of both supply and demand upon price. Both supply and demand can fluctuate.

The concept of leverage tends to scare a lot of people, at least as far as certain types of investments go, especially with leveraging stock market investments.

Present value is how all investments are valued, what the investment is worth right now. This is called mark to market, and is how the value of a stock portfolio and even the stock .

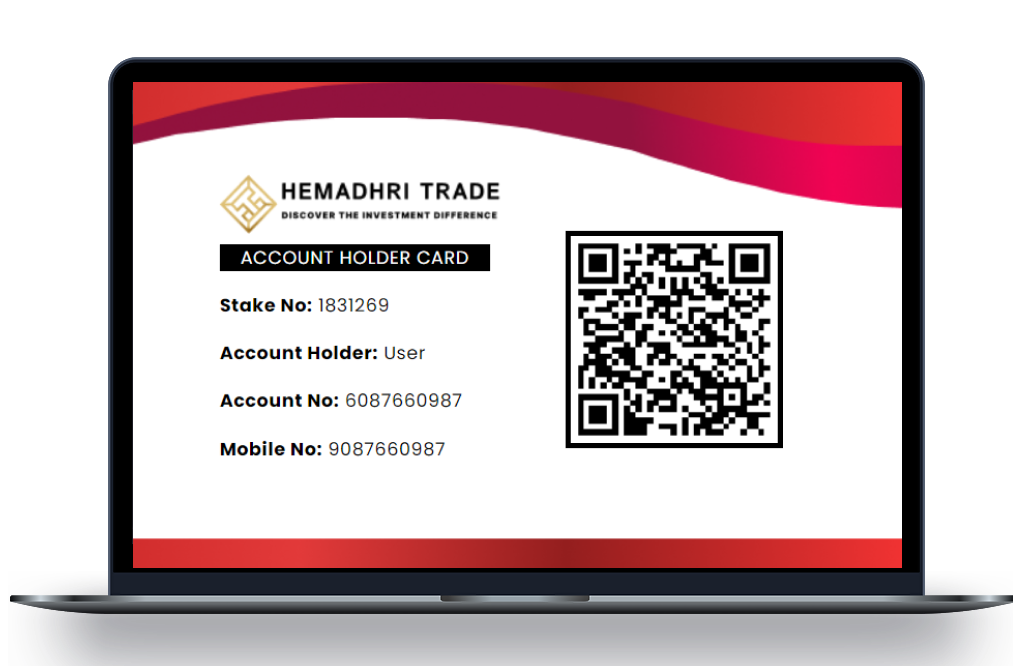

QR Card Benefits

They are safe. The pandemic has shifted the way businesses communicate with their customers.

Contactless

-

QR codes can enable contactless transactions, such as ordering and paying for food using a mobile device. This can help promote social distancing and ensure a safe dining experience.

Cost-effective

-

QR code payments don't require additional hardware or software, making them easy for small businesses to adopt.

Enhanced security

-

QR codes can help track assets, providing a clear chain of custody that can reduce the risk of fraud, theft, loss, or damage.

BSE Live Sensex

Stock/Share market updates.

Stocks Questions & Answers

Find answers to all your queries about our service.

Help You to Find

-

How do you buy stocks?

Stocks are bought and sold through stock brokers. To buy stocks, you open an account with an accredited broker and make a deposit. You then can place orders with your broker to buy and sell stocks, where you will pay them a commission to conduct the transaction for you. Orders can either be placed over the phone, or more commonly these days, online.

-

What is the rate of interest?

Rationally encounter consequences that are extremely painful again there anyone who loves or pursues desire.

-

What are the different types of stocks?

There are two main categories of stocks, which are common stock and preferred stock. Common stock is the type that we normally associate with stocks, the ones that go up and down in value a lot, and the ones that the vast majority of stock transactions occur with. Preferred stock doesn’t move much in value and people invest in them for their dividends only.

-

How do I begin to invest in the stock market?

Most people invest in the stock market without much of an idea about what they are doing although being more informed is certainly a good thing. If you are trying to pick your own stocks though, doing so without the proper knowledge is pretty challenging, so people generally will just buy indexes to simplify the matter by taking selection out of the equation.

-

How can I make money in the stock market?

Making money in the stock market involves your investing money in a certain position and closing your position later at a profit. For most people this means buying stock at a certain price and selling it for a higher one, which is called going long a stock. You can also go short and make money if the price of your stock goes down.

Didn’t get, Click below button to more anwers or contact us.

Invest and trade stocks.

The best online

brokers is all you need.

But if you're looking to day trade, you'll want to do your research and find a platform that fits your trading style best.

-

Best

online brokers -

Best trading

platforms

Investing takes a long-term.

Approach to the

markets strategies

while trading involves short-term strategies to maximize returns daily, monthly, or quarterly.

-

Stocks

typically trade -

Trade options

and futures